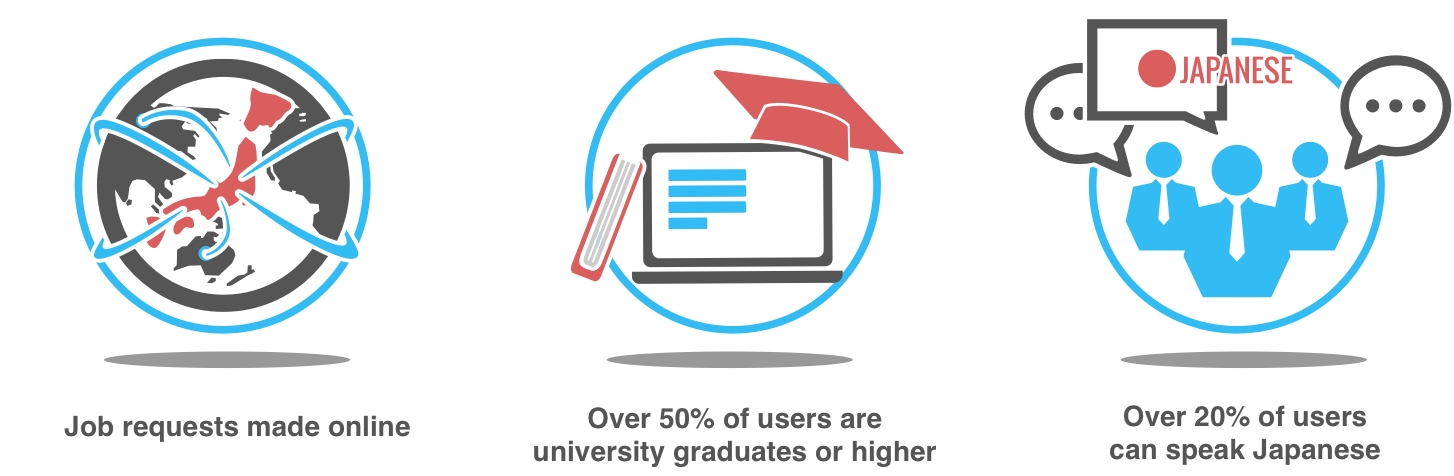

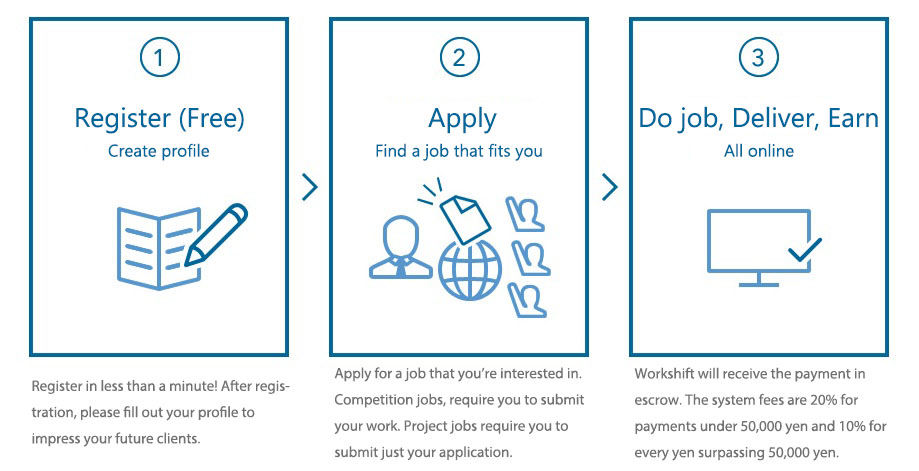

Workshift, the Japanese global

crowdsourcing service, supports

you from job posting to transaction

settlement.

crowdsourcing service, supports

you from job posting to transaction

settlement.

CLICK HERE TO APPLY

MANILA, PHILIPPINES - Call

center agents and other employees with a monthly income of Php 21,000 will be

exempted from paying the personal income tax (PIT), generating savings of over

Php 20,000 annually, under the first package of the comprehensive tax reform

plan (CTRP).

MANILA, PHILIPPINES - Call

center agents and other employees with a monthly income of Php 21,000 will be

exempted from paying the personal income tax (PIT), generating savings of over

Php 20,000 annually, under the first package of the comprehensive tax reform

plan (CTRP).